Indians across generations have been used to dealing with the ubiquitous Life Insurance Corporation of India (LIC) agent, who has pursued and cajoled them into buying life insurance policies – often their first-ever investment.

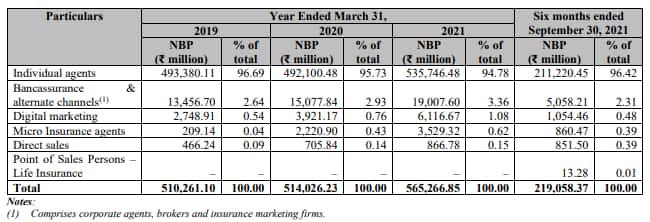

If the central government has banked on LIC to carry out critical rescue acts at the eleventh hour, the state-owned company has relied on its 1.35-million-strong army of agents in its journey towards becoming an omnipresent entity in Indians’ savings portfolio. LIC’s agents make up over 55 percent of the total agent network in the country. Its agency strength is 7.2 times that of SBI Life Insurance, the second-largest life insurer. For the six months ended September 30, 2021, business sourced through agents accounted for 96.42 percent of LIC’s individual new business premiums.

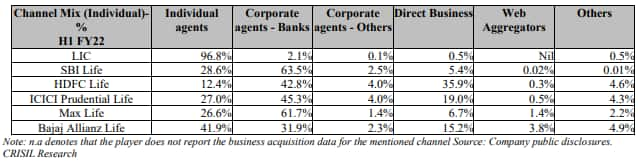

Private players, particularly the ones backed by large banks, on the other hand, depend more on bancassurance channels.

Steps towards expanding digital footprints

While LIC’s dependence on individual agents has helped it reap the benefits of extensive reach, catering to urban and rural areas in the country, the digital medium and competition from private players with banking partners could dent market share, going forward. In fact, LIC has been steadily losing market share to private insurance companies. Until recently, it did not have any tie-up with web aggregators such Policybazaar.com to sell its policies online, though it does have its proprietary portal and apps.

"Our individual products are primarily distributed by individual agents. There is a growing trend for individual products to be distributed online. Digital technology is a new force that is driving massive changes in the insurance sector…insurers are moving towards adopting a digital services model, enabling customers to complete the entire insurance processes online (from the discovery of information to advice and purchase) either on their own or with the help of a service provider/agent,” LIC notes in its DRHP’s risk factors. And, this could be a challenge for the 65-year-old insurance colossus, unless it carries out wholesale changes in its distribution mix. “Our Corporation’s products are available for purchase online on our Corporation’s website. However, none of our products are available for purchase on third-party websites. For further details on the distribution of our products…If our products remain unavailable for purchase on third-party websites, we may lose market share,” it states. This is a sentiment that resonates with industry analysts too.

Its recent tie-up with Policybazaar is a step towards diversifying the distribution mix. This will improve LIC’s visibility and reach amongst younger customers, say, analysts, though it is too early to ascertain how far it will contribute to actual sales figures.

Agents remain unruffled

Despite the changing scenario, LIC’s agents remain its backbone, the secret to its massive market share of over 60 percent in new business premiums. And its agents seem unfazed by the changing preferences of young, potential policyholders and the new-age policy purchase modes. “LIC-Policybazaar tie-up will not affect agents’ business. Insurance is a highly technical subject. If you were to buy a commodity, online is a good option. But recommending life insurance products entails complex calculations such as Human Life Value, need-based analysis, and so on. Aggregators cannot match up to the kind of services that we can provide,” says LIC agent Malay Chitalia.

Many still find comfort in face-to-face discussions where they can resolve their doubts. “Now, publicity around such tie-ups can create awareness, but people still prefer buying through agents due to the personal touch and tangible offerings. When it comes to selling life insurance policies, a lot of persuasions, risk assessment, and need-based analysis is needed – services that individual agents can provide using their skills and experience,” says Mumbai-based LIC agent Bharat Parekh.

Agents say they score over other platforms in individualized assessment, emotional connect and trust factors. “There is no threat from web aggregators. We recommend policies after understanding their goals and other requirements. For instance, I will not ask a 60-year-old to buy an endowment plan but will recommend a pension policy instead. Ultimately, they want someone to hear them out, a service that only an individual agent can offer,” says Mumbai-based LIC agent Mohan Ganachar. He feels that the younger generation could buy policies from private insurers through online modes, but fall back on physical touch-points for savings products. “Earlier, many felt buying through LIC is a tedious process. Now, it is not so thanks to LIC’s technology initiatives over the year,” he says.

Agents feel largely those looking to buy policies with smaller sums assured would prefer digital channels. “It’s like buying diamonds. You wouldn’t want to buy it online even if the discounts are attractive. So, for large sums assured with higher premiums, people will approach offline channels like ours. Also, agents are like family friends who can help dependents with the claim process in case of the policyholder’s death,” says Parekh.

LIC agents’ added IPO responsibilities

Individual agents are also putting their might behind creating awareness about the upcoming mega IPO – and helping policyholders keen on participating in one of the largest public issues in India. “We have been receiving lot of enquiries regarding updating PAN and Demat details in LIC’s portal. So much so, that we have decided to create a template email to be sent to our clients explaining the process of PAN updation. This is a strong indicator of the huge level of interest in LIC’s forthcoming public issue,” says Ravi Jethani, who runs a LIC agency business and is the founder of Beyond Life.

LIC has close to 29 crore customers while the number of demat accounts in the country stands at around 8 crore. Long-time and new LIC customers, many of them who would be investing in equity for the first time, are enthused about owning a stake in the insurance behemoth. “People are rushing to register their PAN before February 28 (deadline set by LIC as per its DRHP). The sentiment is positive, but we are advising first-timers to check their risk appetite before entering equity markets. We have been telling the elderly policyholders that unlike an LIC policy that offers stable returns, there will be ups and downs in the stock market and they have to be conscious of these risks,” says Parekh.